Mutual fund investments have long been recognized as a ray of hope for financial success in investing prospects. Underneath the promise of development, however, many people have an unavoidable concern: “Is It Possible to Lose Money in Mutual Funds?” Discover the nuances of this topic as we set out to debunk the misconceptions, realities, and investing tactics surrounding the mutual fund industry.

Credits: @WealthTrack

Understanding the Possibility of Loss:

Table of Contents

Can Mutual Funds Lose Money?

Many potential investors are wondering whether mutual funds might result in losses. Mutual funds, while intended to provide diversity and competent management, are not immune to market swings. Economic downturns, interest rate fluctuations, geopolitical crises, and adjustments in investor opinion can all have influence on the value of mutual funds.

Historical Performance:

The past performance of a mutual fund is an important indicator of its risk of loss. Although past performance is no guarantee of future outcomes, examining a mutual fund’s track record might give insight into how it has fared through market volatility. Some funds may have had periods of negative returns, emphasizing the risk of loss.

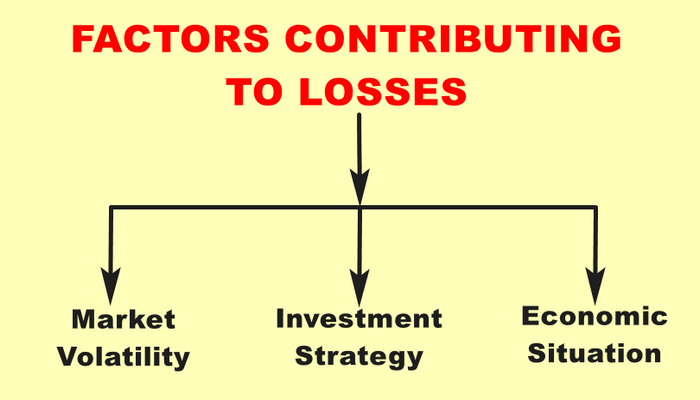

Factors Contributing to Losses:

- Market Volatility: One of the major elements influencing the likelihood of mutual fund losses is market volatility. Mutual fund values are susceptible to changes in the stock and bond markets. A long-term investment perspective is vital since fast market changes might result in short-term losses.

- Investment Strategy: Based on their different investment strategies, mutual funds have different levels of risk. For instance, aggressive growth funds might potentially provide larger returns but have higher volatility, raising the chance of losses.

- Economic Situation: The status of the economy significantly impacts the performance of mutual funds. Variables such as inflation, interest rates, and unemployment can all have an influence on the returns of these products. Economic downturns can result in substantial losses for many different funds.

Recommended: Bajaj Finance Limited: An emerging name in the world of Financial Services

How to Avoid Losses in Mutual Funds?

Here are a few strategies which will help you to avoid losses in Mutual Funds:

- Diversification: It is the best strategy for lowering the risk of losses in mutual funds. To lessen the effects of a subpar investment, diversify your holdings among various industries and asset types (stocks, bonds, and cash equivalents).

- Research and due diligence: It is crucial to conduct extensive research on the mutual funds you are considering. Examine their past results, expense ratios, fund management backgrounds, and investing goals. Funds having a history of surviving market turbulence may be more robust.

- Risk Tolerance Assessment: An assessment of your risk tolerance is essential before investing in mutual funds. Your financial objectives, time horizon, and level of comfort with market swings are just a few examples of the variables that might affect your risk tolerance. To prevent making irrational judgments during times of market volatility, match your investments with your level of risk tolerance.

- Asset Allocation: It’s essential to create an asset allocation strategy that corresponds to your financial goals. Your risk tolerance and time horizon must coincide with the asset allocation you choose.

- Long-Term Perspective: Maintaining a long-term perspective is essential for investing in mutual funds. Market swings over the short term are common and frequently brief. Staying involved over the long term gives you the chance to perhaps recoup losses and profit from market recoveries.

- Regular Monitoring: It’s critical to have a long-term view while also keeping an eye on your assets. You may stay on course by periodically evaluating the performance of your portfolio and changing your approach if your objectives or risk tolerance change.

- Avoid Making Emotional Investing Decisions: Panic and fear can cause rash investing decisions that might cost you money. Refrain from making emotional decisions based on transient market fluctuations. Instead, rely on your research and investing plan.

Frequently Asking Questions:

1. Can My Mutual Fund Go to Zero?

A mutual fund’s value might decrease dramatically, albeit it is doubtful that it could approach zero totally. The value of the assets that make up mutual funds is impacted by the market. This risk may be reduced by diversification and cautious fund selection, but it’s crucial to realize that assets might lose value.

2. What to Do If Mutual Fund Is Falling?

If the value of your mutual fund is decreasing, think about taking the following actions:

- Stay Calm: Steer clear of forming snap judgments based on feelings.

- Review Fundamentals: Review the fund’s underlying fundamentals to see whether anything has changed.

- Long-Term Focus: If your investing objectives continue the same, keeping involved may be a good idea.

- Diversification: Make sure your portfolio is diversified to lessen the impact of the decline of one fund.

3. How Do I Stop Being Scared of Losing Money?

Getting over the fear of losing entails:

- Education: Become familiar with the dangers involved with investing.

- Risk Tolerance: Understand your level of risk tolerance and match your investments.

- Long-Term Perspective: Focus on your objectives and the possibilities for long-term growth from a long-term perspective.

- Start Small: To gain confidence gradually, start with modest investments.

4. Why Do I Always Lose Money When I Invest?

Losing money consistently can be caused by a number of things:

- Lack of Research: Poor investment decisions may result from a lack of proper research.

- Market Timing: It might be dangerous to try and time the market.

- Overtrading: Frequent buying and selling can lead to losses due to transaction fees.

- Lack of Diversification: Concentrated portfolios are more vulnerable to swings in a single asset.

5. How Do I Recover Money Lost in Investment?

Losses must be recovered from strategically:

- Assess Mistakes: Analyze mistakes made and draw lessons from them.

- Patience: Recovering requires time, so be patient and don’t act hastily.

- Rebalance: Modify your portfolio to better suit your objectives.

- Long-Term Perspective: Maintain your investment strategy in the long term to benefit from any future growth.

6. Has Anyone Lost Money in Mutual Funds?

Yes, losses in mutual funds have been experienced by investors. The degree of loss is influenced by a number of variables, including market circumstances, fund choice, and investment strategy. This risk can be reduced by diversification and thorough study.

7. Why Mutual Funds Are Going Down in 2023?

Mutual fund performance may be impacted by market circumstances, economic considerations, and international events. To handle these changes, it’s critical to keep a careful eye on market trends, be knowledgeable, and maintain a diverse portfolio.

8. Why Are All Mutual Funds Going Down Today?

Due to market volatility, daily swings are typical. Daily market moves are influenced by elements including economic news, geopolitical developments, and investor emotion. Diversification provides protection against abrupt reductions.

9. Why Are Mutual Funds Going Down in the United States?

Mutual funds in the United States may face losses as a result of alterations in the national economy, interest rates, the state of the world markets, or problems unique to a particular industry. Losses in a particular area are lessened by a diverse portfolio.

10. Can a Mutual Fund Go to Zero?

Theoretically, large losses for mutual funds are possible, albeit they are uncommon. However, trustworthy mutual funds are run by experts to avoid these results. This risk can be decreased by diversifying among funds and asset types.

11. Should I Invest in Mutual Funds When the Market Is Down?

Investing during a market downturn might offer possibilities for purchases:

- Buy Low, Sell High: Buying assets at a discount might result in greater returns down the road.

- Approach with a Long-Term Perspective: If you have a long-term investing vision, momentary market downturns are less troubling.

12. Are Mutual Funds Safe for the Long Term?

If picked carefully, mutual funds can be good for the long term:

- Diversification: Risk distribution across various assets and industry sectors.

- Research: Do your research and choose funds with a proven track record.

- Risk Assessment: Make sure the fund fits your level of risk tolerance.

- Regular Monitoring: Review and modify your portfolio as necessary.

Conclusion:

“Is it possible to lose money in mutual funds?” The answer to this issue, which weighs heavily on investors’ thoughts, is indeed. You may avoid the possible errors, though, by having a thorough awareness of the elements that lead to losses and by putting strategic measures like diversification, research, risk assessment, and a long-term view into action. Although there are always dangers associated with investing, making well-informed choices and following disciplined tactics may help you navigate the volatile financial markets and work toward achieving your investment objectives. Consulting with financial experts can provide specialized insights that improve your investing journey even more.