Hello, and welcome back to another informative content. This article is all about CBA dividend dates 2023. So, without wasting time, let’s start with a short introduction.

Short Introduction About The Commonwealth Bank of Australia (CBA)

Table of Contents

Commonwealth bank of Australia is an Australian multinational bank that does business with developed countries such as the United States, the United Kingdom, and New Zealand. It’s the largest Australian bank, founded in 1911 by the Government of Australia. In 1996, it became a privately owned bank after 85 years of operation. The company provides various financial services, including retail, business, institutional banking, funds management, insurance, brokerage, investment, and more.

Commbank got listed in the Australian Securities Exchange Ltd in 1991 with ticker code CBA. Its headquarters are located in Sydney. Well, this was just a small introduction to CBA. Well, this is just a small introduction to CBA.

In this article, you will know about the CBA dividend dates for the years 2021, 2022, and 2023.

CBA Financial Calendar 2023

| SUMMARY | PREVIOUS DIVIDEND | NEXT DIVIDEND |

| Status | Paid | Forecast |

| Type | Final | Interim |

| Per Share | 210c | – |

| Declaration | 10 August 2022 (Wednesday) | 8 February 2023 (Wednesday) |

| Ex-div Date | 17 August 2022 (Wednesday) | 15 February 2023 (Wednesday) |

| Pay Date | 29 September 2022 (Thursday) | 29 March 2023 (Wednesday) |

CBA Dividend Dates 2023

| EVENT | DATE |

| The first quarter trading update (1Q23) | 15 November 2022 |

| An announcement of half-year results and interim dividends will be made on | 15 February 2023 |

| The record date for the interim dividend | 23 February 2023 |

| DRP participation deadline | 24 February 2023 |

| Interim dividend payment date | 30 March 2023 |

| Date of full-year results and final dividend announcement | 9 August 2023 |

| The ex-dividend date for the final dividend | 16 August 2023 |

| The record date for the final dividend | 17 August 2023 |

| DRP participation deadline | 18 August 2023 |

| Final dividend payment date | 28 September 2023 |

| 2023 Annual General Meeting | 11 October 2023 |

A financial calendar tracks all types of financial information throughout a fiscal year, such as profits, losses, dividends, and taxes. The financial calendar in Australia starts from 1st July to 30st June.

Note: The above information has been derived from the official website of CBA (Commonwealth Bank of Australia) and provides information about CBA Financial Calender 2023 and CBA Dividend 2023.

The Estimated CBA Dividend In 2023

In the earlier 2023, the banking experts revealed its full-year estimated results and declared a $2.10 per share dividend. For Financial Year 2022, the CBA dividend was $3.85 per share, up 10% from the last year, 2021. According to the Credit Suisse team, Financial Year 2023 will be a great year for investors.

Technical experts predict a fully franked dividend of $4.25 per share over the next 12 months. As a result, the dividend yield of CBA (Commonwealth Bank of Australia) investors will increase by 10.3% year over year and equal a generous 4.6% yield due to recent weakness in the CBA share price.

While Credit Suisse only has a neutral rating on Australia’s biggest bank, its price target is significantly higher than its current price. It is expected that dividend yields for all four big banks will increase in the Financial year 2023 and Financial Year 2024.

CBA Dividend Dates 2022

You may also be interested to know the CBA Dividend Dates for 2022.

| Event | Date |

| The first quarter trading update (1Q22) | 17 November 2021 |

| An announcement of half-year results and interim dividends will be made on | 9 February 2022 |

| The ex-dividend date for the interim dividend | 16 February 2022 |

| The record date for the interim dividend | 17 February 2022 |

| DRP participation deadline | 18 February 2022 |

| Interim dividend payment date | 30 March 2022 |

| Closing date for receipt of director nominations before the General Meeting | 9 August 2022 |

| Full-year results and final dividend announcement date | 10 August 2022 |

| The ex-dividend date for the final dividend | 17 August 2022 |

| The record date for the final dividend | 18 August 2022 |

| DRP participation deadline | 19 August 2022 |

| Final dividend payment date | 29 September 2022* |

| 2022 Annual General Meeting | 12 October 2022 |

Note: The data in the above table regarding the CBA Dividend Dates 2022 are taken from the official website of the Commonwealth Bank of Australia.

Recommended: NAB Dividend Dates 2022

CBA dividend dates 2021

| Event | Date |

| The 1st quarter trading update (1Q21) | 11 November 2020 |

| An announcement of half-year results and interim dividends will be made on | 10 February 2021 |

| The ex-dividend date for the interim dividend | 16 February 2021 |

| The record date for the interim dividend | 17 February 2021 |

| DRP participation deadline | 18 February 2021 |

| Interim dividend payment date | 30 March 2021 |

| The 3rd quarter trading update (3Q21) | 12 May 2021 |

| Closing date for receipt of director nominations before the General Meeting | 10 August 2021 |

| Full-year results and final dividend announcement date | 11 August 2021 |

| The ex-dividend date for the final dividend | 17 August 2021 |

| The record date for the final dividend | 18 August 2021 |

| DRP participation deadline | 19 August 2022 |

| Final dividend payment date | 29 September 2021* |

| 2021 Annual General Meeting | 13 October 2021 |

Note: The data in the above table regarding the CBA Dividend Dates 2021 are taken from the official website of the Commonwealth Bank of Australia.

Is it a good idea to invest in CBA shares?

According to records, the bank has experienced significant growth, so holding shares of ASX: CBA could prove profitable. Additionally, blue-chip companies have usually paid shareholders around 10% in the past. Consequently, ASX: CBA could provide passive income and profitable dividends. The Commonwealth Bank offers dividend reinvestment plans to shareholders that allow them to reinvest their dividends.

Credits: 7News Australia | YouTube

In the above video, you will see how the Commonwealth Bank grew strongly during the inflation period.

You may also check Rivian stock price prediction 2025

Does the CBA share price represent good value?

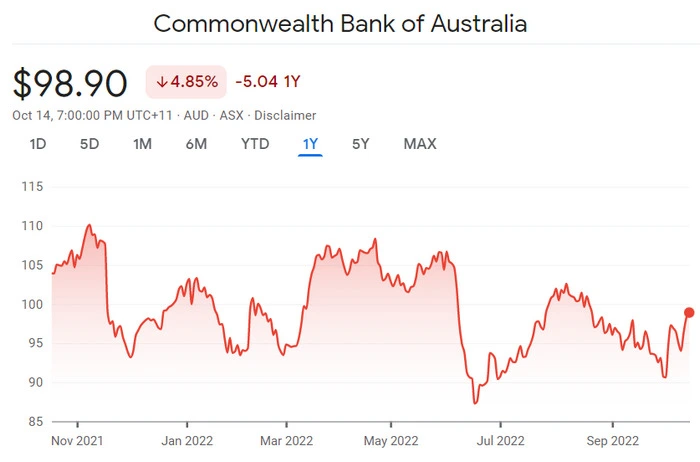

According to most financial experts, currently, CBA share is overpriced. According to analysts, it would be best to buy CBA stock between $87 and $93 for long-term investors.

Its current market price is AU $98.90 and we believe it will break the $100 level very soon.

Recommended: NIO Stock Forecast 2023

A brief overview of CBA shares:

| Market cap | 168.08 Billion |

| P/E ratio | 18.27 |

| Dividend yield | 3.89% |

| 6-Month High | AUD 106.71 |

| 52-wk low | AUD 87.55 |

| CBA Dividend 2022 | $1.75 interim and 2.10c final |

| CBA dividend 2023 | Not announced yet |

Some Frequently Asking Questions About CBA:

What are dividend payment dates?

It is the day on which a company pays its dividends to eligible shareholders. A few weeks after the ex-dividend date, the payment will be made.

What are the highest CBA shares have ever been?

The CBA share price reached a high of $110.19 on 8 November 2021.

What is the CBA final dividend in 2022?

According to the Commonwealth Bank of Australia, its second half financial year ended on 30 June 2022 with a dividend of $2.10.

What dates are dividends paid?

It takes almost a month for dividends to be paid after the record date.

Does Commsec reinvest dividends?

DRIP allows dividends to be reinvested, resulting in higher compounding.

Recommended: Amazon stock forecast 2023

Conclusion:

In this article, you read about the CBA dividend dates 2023. For any queries, you may write in the comment box. For more interesting topics, you may visit the homepage of beforecart.com.

Thanks for reading!